Introduction to Income Tax Software

Income tax filing is an important activity the employee performs to abide by the Government regulations.

Income tax is also a financial process that requires quite a good amount of knowledge about finance as well as the Income-tax act.

The income tax software of Smarthrmscloud simplifies the process and makes it easy for the organisation and the employee to perform income tax filling abiding statutory compliance.

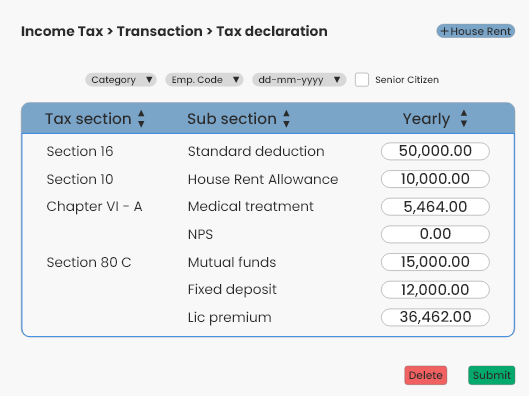

Declaration Entry

House Rent Entry

House rent entry based on the metro and non-metro areas can be declared here. TDS amount deducted from the previous company can also be transferred and considered to the income tax software.

Under Section 10

Section 10 includes tax exemptions like education allowance, medical reimbursements and conveyance allowance ETC. These exemptions are subjected to government regulations and can be changes whenever necessary.

Under Section 16

Reimbursements from standard deductions and entertainment allowance can be claimed here.

Under Section 80C

Tax exemptions for investments like ULIPs, mutual fund, FD etc. can be made with section 80 C of income tax software of smart HRMS.

Under Chapter VI - A

Tax claims for investments made in National pension scheme, section 80D – Medical premium (Mediclaim), Section 80DD, Section 80DDB can be made.

Other Income

Other income apart from salary can be entered here like rent, Interest on housing property, Income from housing property, Incentive etc., If the employees want to add any other income or claim other expenses like interest on loans, they can perform the same with our payroll software.

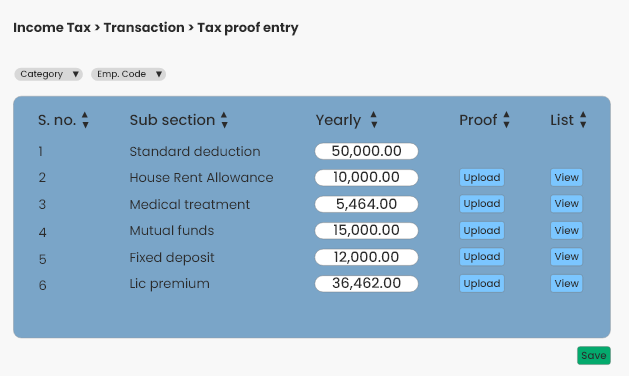

Tax Proof Entry

Proof wise Entry

Proofs that support the tax declarations can be added here. As per government regulations the proofs have to be submitted. The same values can be considered during tax filling.

Declaration Lock

Tax declaration can be locked before tax process so that employees make no late entries in income tax software. If the employee needs to declare income on the last minute, the same can be performed with HR approval.

Upload & View Proofs

Viewing and editing of Tax proofs can be managed by the employees in income tax software.

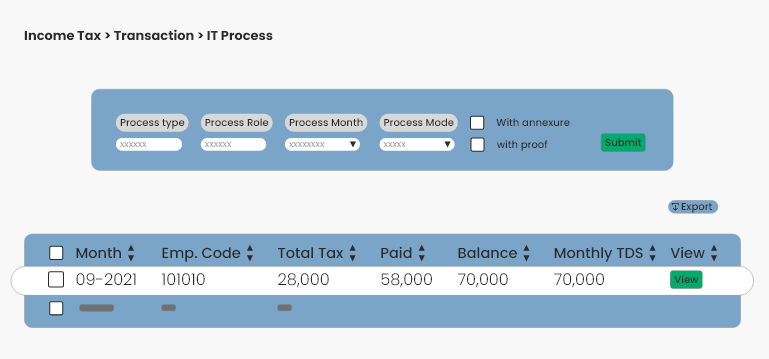

Income Tax Process

Financial Settings

Financial year period, PAN/GRN no., Tax deductions can be saved. The same data can be transferred to the upcoming financial year.

Income Matching

Basic pay, HRA, Fixed Gross segregation of employee salary can be performed in our income tax software. This module helps you to categorise income to support necessary tax deductions.

Process Income Tax

With this option, the income tax based on previously entered declarations can be processed. The user can also view and download the tax worksheet.

Income Tax Process with Proof

Income tax for the employees can be processed based on tax proofs or the tax declared by the employee will be considered.

Payroll with Income Tax Process

If an organisation wishes to lock the payroll for any number of employees, SMART HRMS CLOUD has an option to lock the payroll for the set period, later the lock can be reverted. The option is used to make sure none other than the HR accesses the payroll module.

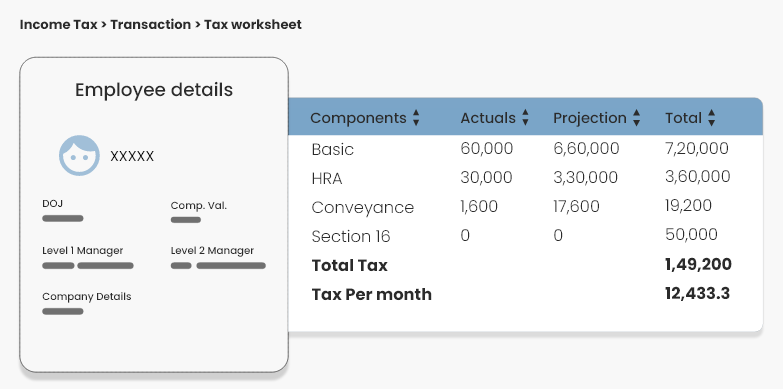

Process Worksheet

Projection Setting

Based on the earning components of the months for which the salary is paid, we can map the projection components for the remaining months of the year.

View History

Tax history of the employees can be viewed with income tax software.

View & Download Worksheet

Employee tax worksheets can be downloaded and viewed.

Individual tax calculator:

Using this calculator, the employee can find the total tax payable by entering their earnings.